vermont sales tax on alcohol

Sales tax region name. Beer and wine are subject to Vermont sales taxes.

An additional tax to consider is the local option sales tax.

. Vermont myVTax for online filing of Sales. Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. Liquor sales are only permitted in state alcohol stores also called ABC Stores.

Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. 2018 No significant enactments 2017 Delaware. The Office of Education provides education services to licensees bartenders servers store clerks consumers parents teenagers and anyone else who needs to know how to make sure alcohol.

The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. The first is an alcohol sales tax of 10 plus a 1 local option tax in some cities. Vermont Taxes and the Manufacture and Sale of Alcoholic Beverages.

Effective June 1 1989. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities. Vermont Liquor Tax 15th highest liquor tax.

This means that an individual in the state of Vermont purchases school supplies and books for their children. Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. The Essex Junction Sales Tax is collected by the merchant on all qualifying sales made within Essex Junction.

A Vermont Alcohol Tax can only be obtained through an authorized government agency. Vermont has state sales tax of 6. See definition at 32 VSA.

90 on sales of prepared and restaurant meals. Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax. This is a tax that towns in Vermont can opt to include bumping the sales tax from six to seven percent on alcohol.

Brewers Winemakers and Distillers. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

The sales tax rate is 6. Of tax is 500000 plus 15 percent of gross revenues over 10000000. Download all Vermont sales tax.

Vermont state sales tax. Tax rates last updated in April 2022. The 7 sales tax rate in Manchester consists of 6 Vermont state sales tax and 1 Manchester tax.

For beverages sold by holders of 1st or 3rd class liquor licenses. 90 on sales of lodging and meeting rooms in hotels. Increased the alcoholic beverage tax rates for beer wine and spirits.

The state sales tax is 6. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format. The South Burlington Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 South Burlington local sales taxesThe local sales tax consists of a 100 city sales tax.

The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax. The second is an excise tax which us 27 cents per gallon of beer and 55 cents per gallon of wine. The first is an alcohol sales tax of 10 plus a 1 local option tax in some cities.

See definition at 32 VSA. The second is an excise tax which us 27 cents per gallon of beer and 55. Local sales taxes can bring the total to 7.

Alcoholic Beverage Sales Tax. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on.

The Division of Liquor Control is responsible for the sale of spirits and the enforcement of laws and regulations regarding alcohol and tobacco in Vermont. The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax. The tax rate is 6.

An example of items that are exempt from Vermont sales tax are items specifically purchased for resale. Average Sales Tax With Local. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

Modified the states alcohol tax by shifting it from a floor tax to a sales tax for wholesalers. Beer and wine which are not part of the control system face two types of taxes in Vermont. Certain Municipalities may also impose a local option tax on meals and rooms.

Vermonts excise tax on Spirits is ranked 15 out of the 50 states. While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected. Altered the liquor tax by changing it from a graduated rate to a flat 5 tax.

Federal excise tax rates on various motor fuel products are as follows. Sales and Use Tax 32 VSA. The tax on any alcohol beverage served on-premises is 10.

There are a total of 153 local tax jurisdictions across the state collecting an average local tax of 0156. The South Burlington Sales Tax is collected by the merchant on all qualifying sales made within South Burlington. Sales and Use Tax Return form 451 Statutes Advisories 7 VSA.

Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Vermont Alcohol Tax. All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. 279 Direct Shipper Requirements.

3 if the gross revenue of the seller is over 20000000 the rate of tax is 25 percent 10. The price of all motor fuel sold in Vermont also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway Administration. Tax Rates for Meals Lodging and Alcohol.

277 Direct-To-Consumer License. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. 100 on sales of alcoholic beverages served in restaurants.

Vermont Gold Vodka Prices Stores Tasting Notes Market Data

Vermont Cigarette And Tobacco Taxes For 2022

Adirondack House House Home House Plans

4 Day Vermont Bike Tours 4 Day Cycling Trip In Vermont Trek Travel

Which States Have The Lowest Property Taxes Property Tax Usa Facts American History Timeline

Perceptual At Product Category Level Perceptual Map Interesting Questions Alcohol Mixers

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Alcohol Taxes On Beer Wine Spirits Federal State

A New Wave Of Vermont Distillers Pushes Legislators To Modernize Liquor Laws Business Seven Days Vermont S Independent Voice

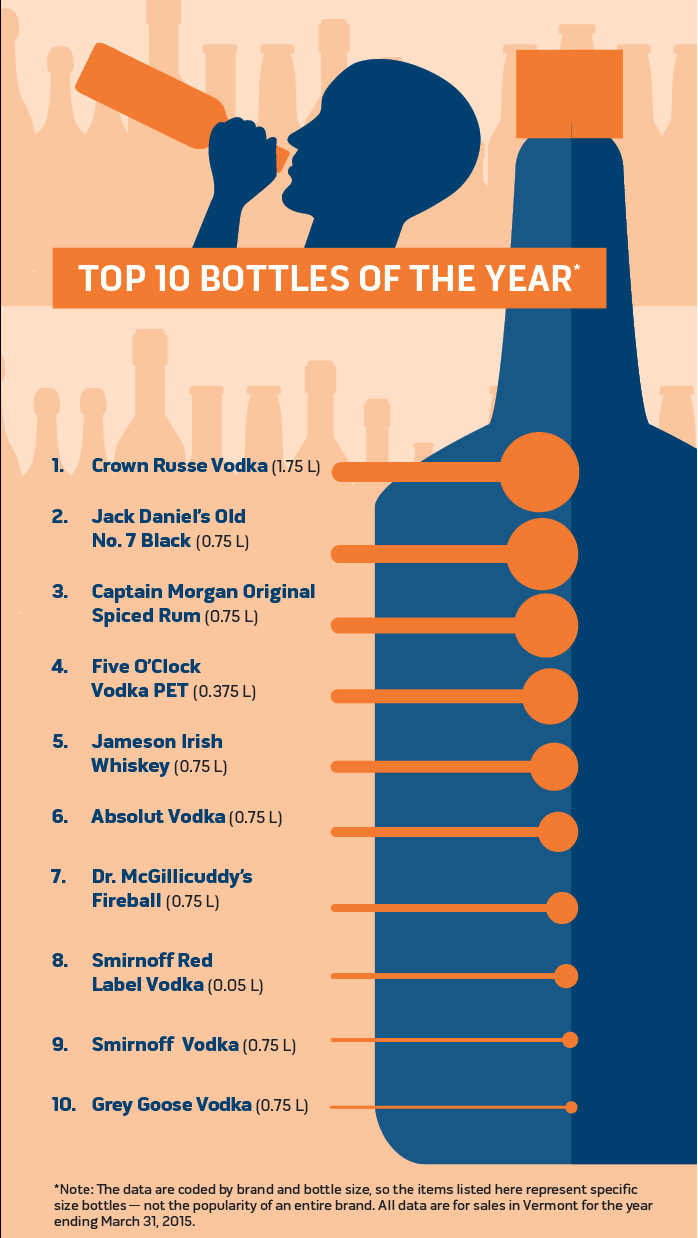

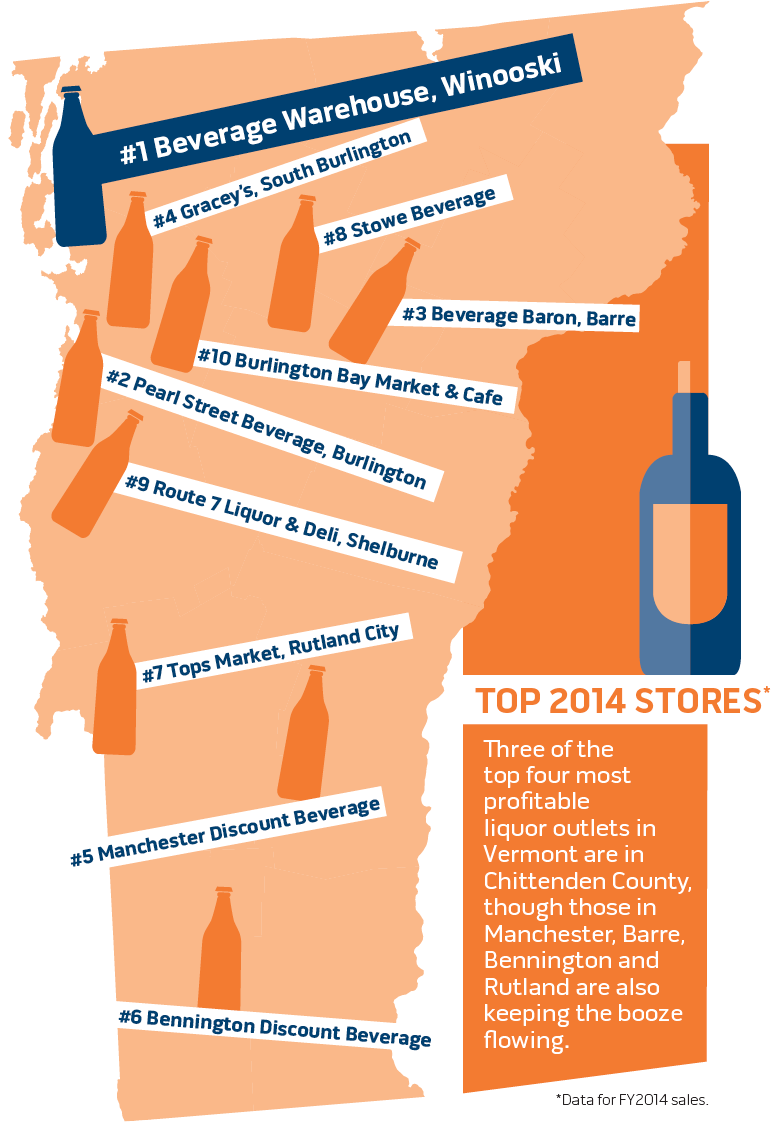

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

New State Laws On Sexual Consent Health Care And Alcohol Sales Take Effect July 1 Vtdigger

Run A Store Selling Beer Wine Or Tobacco Division Of Liquor Control

Scott Pulls Russian Alcohol From Vermont Shelves Vtdigger

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

A New Wave Of Vermont Distillers Pushes Legislators To Modernize Liquor Laws Business Seven Days Vermont S Independent Voice